Jumbo Loan: Funding Options for High-Value Properties

Jumbo Loan: Funding Options for High-Value Properties

Blog Article

The Effect of Jumbo Lendings on Your Financing Choices: What You Required to Know Prior To Using

Jumbo car loans can play a critical role in forming your funding choices, especially when it comes to obtaining high-value buildings. Recognizing the equilibrium between the obstacles and benefits posed by these loans is crucial for potential customers.

Recognizing Jumbo Finances

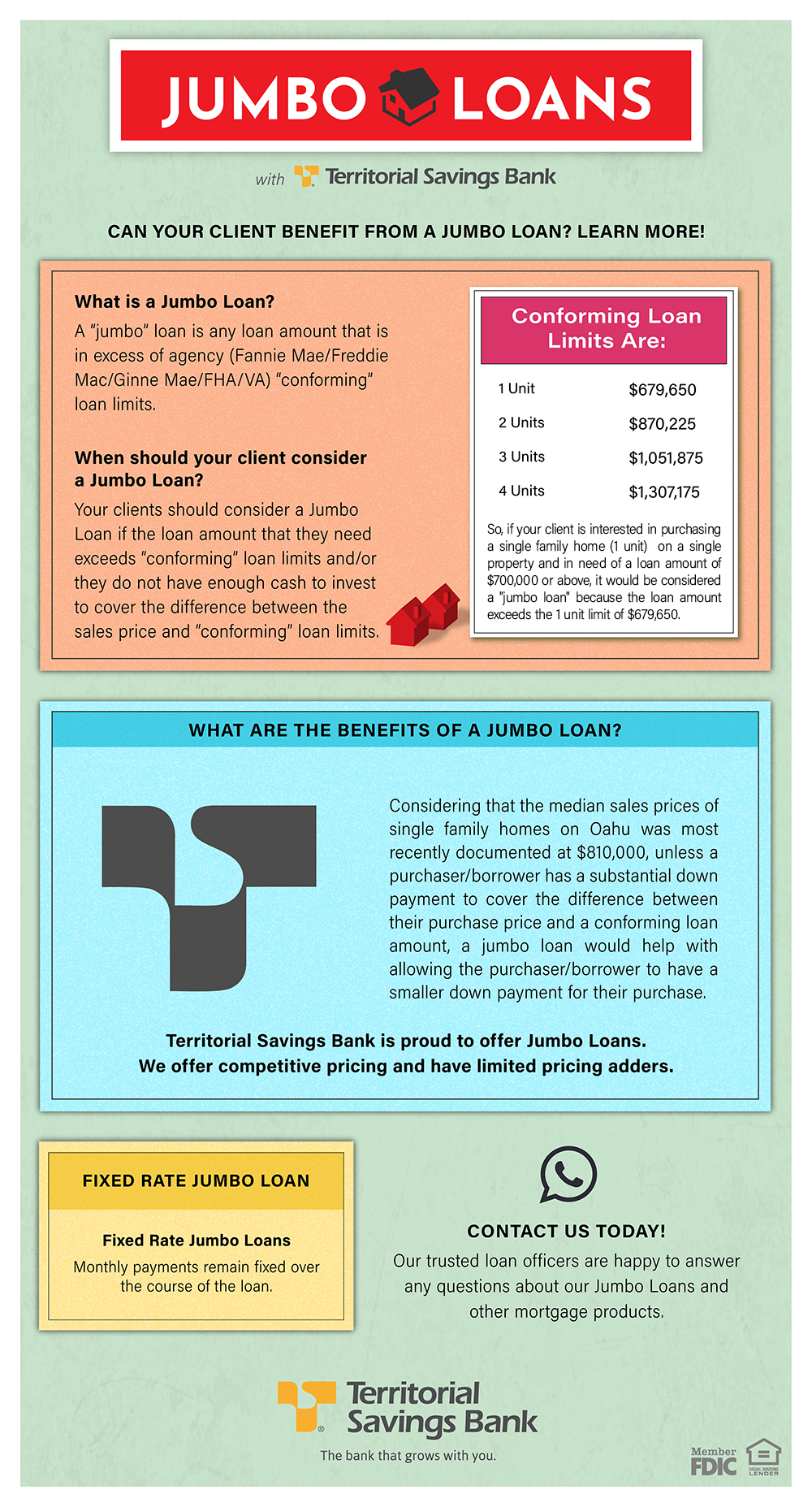

Recognizing Jumbo Loans calls for a clear understanding of their special qualities and demands. Big lendings are a type of home mortgage that surpasses the conforming lending limitations established by the Federal Real Estate Financing Firm (FHFA) These limitations differ by location yet commonly cap at $647,200 in most areas, making jumbo lendings crucial for financing higher-priced properties.

Among the defining attributes of jumbo finances is that they are not qualified for acquisition by Fannie Mae or Freddie Mac, which leads to more stringent underwriting standards. Customers have to often demonstrate a greater credit report, normally over 700, and supply significant documentation of earnings and properties. In addition, lenders may need a bigger down payment-- typically 20% or even more-- to minimize danger.

Rates of interest on jumbo financings can be a little higher than those for adhering car loans as a result of the raised risk assumed by the lender. Nevertheless, the absence of personal home mortgage insurance (PMI) can offset some of these costs. Comprehending these aspects is critical for possible consumers, as they significantly influence the terms and expediency of protecting a jumbo car loan in today's competitive realty market.

Benefits of Jumbo Car Loans

Jumbo loans provide distinctive benefits for buyers looking for to buy high-value buildings that exceed conventional loan restrictions. One of the primary benefits of big car loans is their capacity to fund bigger quantities, allowing customers to get homes in costs markets without the restraints enforced by adjusting lending restrictions - jumbo loan. This versatility enables homebuyers to check out a wider series of buildings that might better match their requirements and choices

Furthermore, big fundings frequently feature competitive rate of interest, specifically for consumers with solid credit history profiles. This can lead to considerable cost savings over the life of the car loan, making homeownership a lot more affordable over time. In addition, jumbo loans can be tailored to fit private economic situations, providing different terms and amortization alternatives that straighten with the debtor's objectives.

Challenges of Jumbo Loans

Browsing the complexities of big finances provides a number of difficulties that potential consumers ought to understand prior to proceeding. One substantial hurdle is the stringent loaning standards enforced by banks. Unlike adapting car loans, big fundings are not backed by government-sponsored business, leading lending institutions to embrace even more rigorous requirements. This often includes higher credit history demands and significant documentation to validate income and properties (jumbo loan).

Furthermore, jumbo financings typically come with higher rates of interest compared to traditional financings. This raised price can considerably affect month-to-month payments and total affordability, making it important for customers to carefully analyze their financial situation. The down payment demands for jumbo fundings can be considerable, commonly varying from 10% to 20% or more, which can be an obstacle for many prospective home owners.

Another difficulty exists in the minimal accessibility of big funding items, as not all lenders provide them. This can cause a lowered pool of options, making it crucial for borrowers to carry out detailed research and potentially seek specialized loan providers. Generally, understanding these obstacles is essential for anyone considering a jumbo car loan, as it makes sure enlightened decision-making and far better economic preparation.

Credentials Standards

For those taking into consideration a big loan, meeting the qualification criteria is a vital action in the application procedure. Unlike traditional finances, big finances are not backed by federal government companies, leading to stricter demands.

First of all, a solid try this website credit rating is crucial; most lending institutions need a minimum score of 700. A greater rating not only enhances your chances of authorization however may also secure better passion prices. Furthermore, borrowers are generally anticipated to demonstrate a considerable earnings to ensure they can pleasantly handle higher monthly payments. A debt-to-income (DTI) proportion listed below 43% is normally liked, with lower proportions being a lot more favorable.

Down settlement requirements for big car loans are also considerable. Consumers ought to prepare for taking down a minimum of 20% of the residential or commercial property's acquisition price, although some loan providers might offer choices as reduced as 10%. Additionally, demonstrating cash reserves is important; lenders frequently require evidence of adequate liquid properties to cover several months' well worth of mortgage repayments.

Contrasting Funding Options

When examining funding alternatives for high-value buildings, understanding the differences between different finance types is necessary. Big lendings, which surpass adhering funding limitations, normally featured stricter qualifications and higher rates of interest than standard car loans. These financings are not backed by government-sponsored enterprises, which increases the lender's risk and can result in extra rigorous underwriting requirements.

On the other hand, conventional lendings offer even more adaptability and are commonly much easier to acquire for borrowers with strong credit rating profiles. They may feature lower rate of interest and a larger array of alternatives, such as dealt with or adjustable-rate home loans. Furthermore, government-backed car loans, like FHA or visit this website VA lendings, give chances for lower down settlements and even more lenient credit report demands, though they additionally impose limits on the financing amounts.

Conclusion

To conclude, big fundings existing both chances and difficulties for possible buyers looking for funding for high-value residential or commercial properties. While these lendings enable for larger amounts without the problem of exclusive home mortgage insurance policy, they feature rigid credentials requirements and possible downsides such as greater rates of interest. A comprehensive understanding of the benefits and challenges related to jumbo finances is crucial for making educated decisions that straighten with long-term financial objectives and goals in the realty market.

Report this page